Receive Payments Quickly

Receiving payments quickly means that the payment is processed and transferred to the recipient’s account promptly and efficiently. It can refer to various payment methods, including electronic payments, credit card transactions, and direct deposit.

In general, receiving payments quickly is important because it allows individuals and businesses access funds they may need for various purposes, such as paying bills or investing in their business. A fast payment processing time can also help improve cash flow and reduce the risk of late fees or penalties. In this article, we will explain to you the Ways, benefits, and factors affecting receiving payments quickly.

In general, receiving payments quickly is important because it allows individuals and businesses access funds they may need for various purposes, such as paying bills or investing in their business. A fast payment processing time can also help improve cash flow and reduce the risk of late fees or penalties. In this article, we will explain to you the Ways, benefits, and factors affecting receiving payments quickly.

Ways to Receive payments quickly

There are several ways to receive payments quickly:

Use electronic payment methods: Electronic payment methods like PayPal, Stripe, and other online payment platforms allow for quick and easy payments. They can be integrated into your website or online store, making it simple for customers to pay.

Use electronic payment methods: Electronic payment methods like PayPal, Stripe, and other online payment platforms allow for quick and easy payments. They can be integrated into your website or online store, making it simple for customers to pay.

Offer multiple payment options: Offering multiple payment options gives customers flexibility in choosing a payment method they prefer. This can include credit cards, debit cards, online bank transfers, mobile payments, and digital wallets.

Offer multiple payment options: Offering multiple payment options gives customers flexibility in choosing a payment method they prefer. This can include credit cards, debit cards, online bank transfers, mobile payments, and digital wallets.

Invoice promptly: Sending out invoices as soon as possible can speed up the payment process. It’s also a good idea to include payment terms and instructions on the invoice to avoid any confusion.

Invoice promptly: Sending out invoices as soon as possible can speed up the payment process. It’s also a good idea to include payment terms and instructions on the invoice to avoid any confusion.

Set up automatic payments: Setting up automatic payments with customers can help ensure payments are received on time. This can be done through online payment platforms or through direct debit.

Set up automatic payments: Setting up automatic payments with customers can help ensure payments are received on time. This can be done through online payment platforms or through direct debit.

Consider using a payment gateway: A payment gateway can help streamline the payment process by securely processing payments and handling transactions. This can include integrating with your website or online store.

Consider using a payment gateway: A payment gateway can help streamline the payment process by securely processing payments and handling transactions. This can include integrating with your website or online store.

Communicate with customers: Regular communication with customers can help ensure they are aware of payment deadlines and any issues that may arise. This can include reminders, follow-up emails, and phone calls.

Communicate with customers: Regular communication with customers can help ensure they are aware of payment deadlines and any issues that may arise. This can include reminders, follow-up emails, and phone calls.

What are the benefits of Receiving payments quickly?

There are several benefits of receiving payments quickly, including:

Improved cash flow: By receiving payments quickly, businesses can have access to funds that they can use for expenses such as payroll, inventory, and bills. This can help improve cash flow and reduce the risk of cash flow issues.

Improved cash flow: By receiving payments quickly, businesses can have access to funds that they can use for expenses such as payroll, inventory, and bills. This can help improve cash flow and reduce the risk of cash flow issues.

Reduced payment processing costs: Processing payments can be costly, especially if there are delays or errors in the payment process. Receiving payments quickly can help reduce payment processing costs by minimizing the need for manual intervention or follow-up.

Reduced payment processing costs: Processing payments can be costly, especially if there are delays or errors in the payment process. Receiving payments quickly can help reduce payment processing costs by minimizing the need for manual intervention or follow-up.

Enhanced customer satisfaction: When customers can make payments quickly and easily, they are more likely to be satisfied with the overall payment experience. This can lead to increased customer loyalty and repeat business.

Enhanced customer satisfaction: When customers can make payments quickly and easily, they are more likely to be satisfied with the overall payment experience. This can lead to increased customer loyalty and repeat business.

Reduced risk of fraud: Delayed payments or payment processing errors can increase the risk of fraud or other financial crimes. By receiving payments quickly, businesses can minimize this risk and improve their overall financial security.

Reduced risk of fraud: Delayed payments or payment processing errors can increase the risk of fraud or other financial crimes. By receiving payments quickly, businesses can minimize this risk and improve their overall financial security.

Improved business efficiency: By automating payment processing and receiving payments quickly, businesses can improve their overall efficiency and reduce the need for manual intervention or follow-up. This can free up staff time for other tasks and help businesses operate more smoothly.

Improved business efficiency: By automating payment processing and receiving payments quickly, businesses can improve their overall efficiency and reduce the need for manual intervention or follow-up. This can free up staff time for other tasks and help businesses operate more smoothly.

What are the factors affecting receiving payments quickly?

Several factors can affect the speed at which payments are received. Some of the most common factors include:

Payment method: Different payment methods have different processing times. For example, electronic payments such as ACH transfers and wire transfers are usually faster than paper checks.

Payment method: Different payment methods have different processing times. For example, electronic payments such as ACH transfers and wire transfers are usually faster than paper checks.

Payment processor: The payment processor used to process payments can also affect the speed at which payments are received. Some processors have faster processing times than others.

Payment processor: The payment processor used to process payments can also affect the speed at which payments are received. Some processors have faster processing times than others.

Banking system: The banking system can also affect the speed at which payments are received. For example, if there are holidays or weekends, it can delay the processing of payments.

Banking system: The banking system can also affect the speed at which payments are received. For example, if there are holidays or weekends, it can delay the processing of payments.

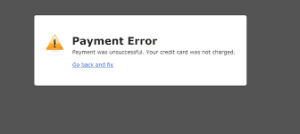

Payment errors: Any errors in the payment process, such as incorrect bank account information or insufficient funds, can also delay payment processing.

Payment errors: Any errors in the payment process, such as incorrect bank account information or insufficient funds, can also delay payment processing.

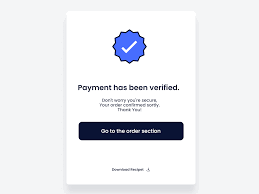

Payment verification: In some cases, payments may need to go through a verification process to ensure that they are legitimate. This can add additional processing time.

Payment verification: In some cases, payments may need to go through a verification process to ensure that they are legitimate. This can add additional processing time.

Currency exchange: For international payments, currency exchange rates and processes can affect the speed at which payments are received.

Currency exchange: For international payments, currency exchange rates and processes can affect the speed at which payments are received.

Payment terms: The payment terms agreed upon between the payer and payee can also affect the speed at which payments are received. For example, if the payment terms include a long payment period, this can delay payment processing.

Payment terms: The payment terms agreed upon between the payer and payee can also affect the speed at which payments are received. For example, if the payment terms include a long payment period, this can delay payment processing.

Use electronic payment methods

Use electronic payment methods Offer multiple payment options

Offer multiple payment options Invoice promptly

Invoice promptly Set up automatic payments

Set up automatic payments Consider using a payment gateway

Consider using a payment gateway Communicate with customers

Communicate with customers Improved cash flow

Improved cash flow Reduced payment processing costs

Reduced payment processing costs Enhanced customer satisfaction

Enhanced customer satisfaction Reduced risk of fraud

Reduced risk of fraud Improved business efficiency

Improved business efficiency Payment method

Payment method Payment processor:

Payment processor: Banking system:

Banking system:  Payment errors:

Payment errors: Payment verification:

Payment verification: Currency exchange:

Currency exchange:  Payment terms:

Payment terms: