Direct Investment

Stop Paying Commission on Mutual fund, Switch to Direct Investment

Direct Investment

Do you still pay the Commission on your Mutual Fund Investments?

Stop, Stop, Stop Now……. Here’s Why?

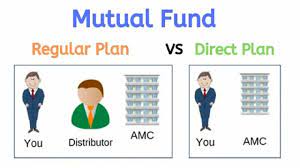

Back in the year 2012, SEBI made several changes and introduced a direct mutual fund investment. With effect from January 2013, each mutual fund comes with two options: a regular (through a broker) and direct investment. In this article, we will discuss Direct vs Regular Mutual Funds.

These are two alternatives to similar mutual funds. This is overseen by a similar fund manager who invests in similar bonds and stocks.

The main difference between both the schemes is that the fund house pays the commission to the intermediary/expert in the form of distribution charges. However, in the case of Direct investment, no such fee/commission is paid.

What are Direct Mutual Funds?

SEBI mandated all AMCs (Asset Management Companies) to start direct mutual fund investments, they are mutual fund schemes that are offered directly by fund houses or AMCs. It has been launched on 01 Jan 2013. This type of mutual fund has a low expense ratio as it does not include distributor expenses and commissions. No commission is to be paid from such Mutual Funds. Direct Mutual Funds have a separate NAV. Investors deal directly with the AMC offering the fund.

What are Regular Mutual Funds (through a broker)?

Regular mutual funds are those mutual fund plans that are bought through a broker, distributor, advisor, or intermediary. Intermediaries charge a fixed fee from the fund house for selling their mutual funds. For each regular mutual fund, the AMC pays a commission to the distributor. The AMC adds the advisor’s commission to the expense ratio. This makes regular mutual funds a little more expensive. Regular mutual funds have additional charges for services purchased by the intermediaries through which you make purchases. Apart from the services, the investor also gets advice on identifying the fund or scheme to invest in.

Direct vs. regular mutual funds

Mutual Funds – Both direct and regular are managed by the same mutual fund manager and investments are also made in the same asset.

AMC does not pay any sales commission in the direct plan. The direct investor has also invested his time and effort in selecting a mutual fund scheme and making a perfect portfolio for himself.

On the other hand, regular plans are commission-based, have a higher expense ratio but provide expert advice to the investor. Therefore, if a particular plan starts at the same time and ends at the same time, the direct plan will give higher returns than the regular plan. But it should also be noted that in a regular scheme, investors could have better advice in fund selection. A financial advisor can save a lot of time by choosing the best plan that suits the needs of the investor.

Comparison of returns from Direct and Regular mutual funds

Below we have taken the example of one mutual fund scheme, and we can analyze the difference between them.

Here we can analyze how direct mutual funds can give better returns to an investor

You can see both the mutual funds (direct and regular) started with the same value on January 1, 2013. Over the years, the NAV of direct plans has risen faster than the NAV of regular mutual funds. This is because direct mutual funds provide better returns than regular mutual funds.

Direct vs regular mutual funds – Which one to pick?

In general, it looks quite easy to understand which plan one should pick for better returns, but the point is:

- Stock market uncertain- For the new investor who wants to start his investment in mutual funds or in the capital market, it has never been a simple path. The stock market is very uncertain hence there is no straight line or fixed 10%/12% or 15% returns. There are times when investors also face negative returns during a short period of time (up to 5 years of sip investment may generate negative returns).

- The decision in the panic situation– So, an individual who chooses a direct plan may stop his further investment or he may withdraw his amount accumulated in a mutual fund. This happens because of negative returns generated by the equity schemes and in tough times mutual fund returns look not attractive compared to bank FD.

- Goal-based planning- It is important that every investor must decide their goal before investing. There are different schemes to select for different goals. One should choose the mutual fund scheme as per their investment horizon. If the investment horizon is for the long term (5 years or above) then only we should go for equity schemes, if the investment horizon is for the short term (1-2 years) or medium-term (2 to 3 years) then we should select liquid funds or short-term debt funds, respectively.

Benefits of Direct and Regular Mutual Funds?

Direct and regular mutual funds are equally important, and they both are beneficial for the investor.

Here we understand the benefits of them one by one.

Direct Mutual Funds benefits:

- Low expense ratio – Since there is no intermediary involved between the investor and the fund house, the expense ratio of a direct fund will be lower than that of a regular fund. Since regular funds pay commission to AMC agents for their services and they recover these expenses through expense ratio which they add to regular funds.

- High NAV – The Net Asset Value (NAV) of a mutual fund is the ratio of the number of outstanding units to the value of the total assets in its portfolio. Since there is no brokerage in direct mutual funds, the NAV of a direct fund will be higher than the NAV of regular funds.

- Higher Returns – Direct Funds do not involve any brokerage or commissions, the expense ratio of Direct Funds will be below. So, in the short term (1 year), it may not seem like a significant difference, but in the long term, it will make a huge difference in the returns of both the mutual funds.

Regular Mutual Funds benefits:

- Expert Advice – A qualified/certified advisor can guide you in choosing the right investment portfolio. They also help you make decisions while choosing financial goals that are important for your life so that investors can better plan goals according to their individual needs.

- Convenient and Smooth Transactions – Ease of transacting is an advantage with an agent or distributor. It is quite easy to select funds to deposit physically or online. It is mandatory for new investors to do the KYC of the investor. Since the distributor has experience in conducting transactions, it is a comfortable and smooth process as far as the transaction is credited.

- Monitoring – Investing in mutual funds may not work for the investor. Example – A good businessman or an employee multinational company that will have many things to complete its work may not take the time to monitor its investments on regular basis. Hence the advisor acts on behalf of the investor to monitor and review the investment and guide the investor accordingly if any changes are required.

Direct and regular mutual funds are suitable for what type of Investors

- Direct Mutual Funds– It is better if the investor has the necessary knowledge and understanding of capital markets to analyze the performance of the mutual funds. Also, they need to allocate time to do these activities. Investors with these capabilities will also be able to invest directly through AMCs.

- Regular Mutual Funds- For those who do not understand the risks involved and cannot keep track of the performance of the fund, it is best to invest through regular mutual funds. It is always better to pay a commission fee than to lose a part of the invested capital due to wrong calculations.

Reason Behind Investing in Direct Mutual Funds

Direct Mutual Funds are the best option for those who want to invest in mutual funds without any intermediary dealing directly with the fund. Fund managers can generate better returns by reducing their expense ratio. The commission when removed increases the returns over the long term.

In the case of direct mutual fund plans, investors are advised to do their own market research and choose the top-performing mutual fund scheme. Investors can access mutual fund websites and blogs and analyze them to know more about suitable mutual fund schemes.

Direct Mutual Funds work best for those who want to increase their returns by investing directly through the fund and can manage all the documents on their own. Though the process may seem a bit complicated in the initial stage, it should be smooth while investing in further plans

Conclusion

The direct investor who has complete knowledge of mutual fund investment and an understanding of the capital market can enjoy 100% of the benefits of his/her investments. Moreover, it can lead to a huge difference over a period of time. Because even a difference of 1% can be a huge gap with the compounding effect in the long-term.