National Pension Scheme

India is a nation that supports its residents and cares about them. As a result, the National Pension Scheme, created by the Indian government, is a Pension program (NPS). NPS was introduced in 2004 by the Pension Fund Regulatory and Development Authority of India as a government-sponsored pension program (PFRDA). The system was specifically developed to protect people’s financial security after retirement. In the NPS plan, participants must consistently contribute to their NPS accounts during their working careers to later benefit from the regular annuity. Additionally, customers can make a partial withdrawal from their NPS account in case of any unforeseen circumstances.

What is National Pension Scheme?

The National Pension System (NPS) is a voluntary, defined contribution retirement savings plan aimed at helping subscribers make the most informed decisions about their future by encouraging them to save systematically during their working years. NPS encourages citizens to save for their retirement.

Who can open an NPS Account?

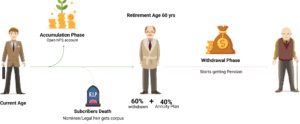

NPS is a government-subsidized retirement plan that was introduced in India in January 2004 for government employees and opened to all classes in 2009. This scheme enables contributors to regularly add to their pension account over their working life. On retirement, they can take out a portion of the capital in a single payment, and use the leftover corpus to acquire an annuity to ensure a steady income after retirement.

To open an NPS account, several conditions must be met. This scheme is only available to the following individuals and citizens:

- Any Indian Citizen

- Aged between 18 and 60 years

- Employees of the private, public, or unorganized sector, excluding the armed forces

- Applicants must be KYC-compliant

- Non-resident Indians can also join the national pension program, however, their account will be canceled if their citizenship changes.

Individuals must open an NPS account through entities known as Point of Presence (POP). Most banks, private and public sector, are enrolled as POPs, in addition to various financial institutions. The approved branches of these POPs, called point of presence service providers (POP-SPs), serve as collection points.

How NPS Works?

NPS is an ideal retirement investment option that residents and non-residents of India are allowed to put a certain sum of money into regularly. It is a safe and long-term investment option that provides investors with market-based returns.

Once the investor has opted for the NPS investment option, they will be given a Permanent Retirement Account Number (PRAN).

The NPS subscriber can contribute to the NPS scheme up until their retirement age. When they retire, they can take out a partial sum in one payment, with the remainder going towards purchasing an annuity plan.

An annuity is a monthly sum that the NPS subscriber receives from an Annuity Service Provider (ASP). An annuity service provider is a licenced insurance provider.

In addition, it is required for the annuity service provider to be registered with PFRDA in order to offer Annuity services to the NPS Subscribers. Moreover, various annuity schemes are available for investors to decide between, such as annuity for life and annuity for life with a return of purchase price on death.

NPS Benefits in India

Flexibility

With NPS, you have the flexibility to choose from a variety of investment options and Pension Funds (PFs). You can easily plan the growth of your investments, monitor the growth of the pension corpus, and switch from one option to another or one fund manager to another.

Simple

NPS offers a unique Permanent Retirement Account Number (PRAN) that stays with the subscriber for life. The scheme is divided into two tiers:

Tier-I account: This is a permanent retirement account with non-withdrawal features; the regular contributions made by the subscriber are invested as per the chosen portfolio/fund manager.

Tier-II account: This is a voluntary withdrawable account, granted only when an active Tier I account is present. The withdrawals are allowed as per the subscriber’s requirements.

Portability

NPS provides seamless portability across jobs and locations, allowing subscribers to transition without leaving any of their accumulated corpus behind, which is the case with most pension schemes in India.

Well Regulated

NPS is regulated by PFRDA, with transparent investment guidelines, regular monitoring, and performance review of fund managers by NPS Trust. The account maintenance costs under NPS are lower than any similar pension product across the globe. When saving for long-term goals like retirement, the cost is a major factor, as charges can take a significant amount out of the corpus over the course of 35-40 years of investment.

Dual Benefit of Low Cost and Power of Compounding

Until retirement, pension wealth accumulates over time with a compounding effect. With account maintenance charges being low, the benefit of accumulated pension wealth to the subscriber eventually becomes large.

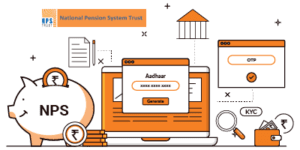

Ease of Access

The NPS account is manageable online. An NPS account can be opened through the eNPS portal, and further contributions can be made online through the eNPS portals of CRAs.

NSDL CRA

Kfintech CRA

What are the disadvantages of NPS?

The NPS (National Pension Scheme) has its disadvantages compared to other investment and pension-related options. The following are the disadvantages of investing in the NPS scheme.

No pension or annuity

One of the primary misconceptions about NPS is that it will give a monthly pension once the individual retires. However, this scheme is intended to accumulate retirement funds. The subscriber can then purchase an annuity or pension product using these funds.

Tax implications

Despite the fact that an investment in NPS is exempted under Section 80C, the corpus accumulated at the time of retirement is liable to taxation. Out of the total corpus, the subscriber is allowed to withdraw 60% of the investment when they reach the age of 60. This amount is tax-free. The remaining 40% of the investment is used to purchase an annuity that provides a monthly pension to the investor, which is taxable.

Restriction on withdrawal

An Investor can withdraw only 25% of the total amount if they invest continuously for 3 years in their NPS account. Additionally, the investor can withdraw only 3 times before they reach the age of 60. Moreover, there must be a 5-year gap between the current and previous withdrawals. Also, withdrawals are permitted for certain occasions, such as a child’s marriage, higher education, buying a new house, and medical treatment for self or family.

No guaranteed returns

The return of the NPS scheme is variable and subject to the performance of the underlying security. Given this, the amount of return can be impacted by changes in the market.

National Pension Scheme

| Particulars | National Pension System Tier I Account Details | National Pension System Tier II Account Details |

| Minimum Amount | The Tier I account requires a minimum investment of Rs 500 or Rs 1000 in a year | The tier II account requires a minimum investment of Rs 250 must |

| Maximum Amount | There is no limit on the maximum amount of investment under Tier I account. | There is no limit on the maximum amount of investment under the Tier II NPS account. |

| Withdrawals | Not Allowed for Tier I NPS account | Allowed for Tier II Account |

| Tax Benefits | Deduction under section 80C up to Rs 1.5 lakh. Deduction under section 80CCD up to Rs 50000 | Government Employees – Deduction under section 80C up to Rs 1.5 lakh others– No deduction |

Frequently Asked Questions

Q1. What is the definition of an exit?

An exit is the closing of the user’s personal pension account under the National Pension System. the following circumstances; (i) Upon turning 60 years old and being superannuated; (ii) Prior to turning 60 years old and becoming superannuated; (iii). any time from the time of reaching the age of 60 to the age of 75; (iv) As a result of physical infirmity or upon turning 60 years old or reaching retirement age; (v) As a result of death or subscriber being reported missing

Q2. What procedures should People follow to exit NPS?

A subscriber shall submit an application for exit or withdrawal for the purpose of withdrawing Exit benefits as provided in the regulations on or before the expected date of exit Through Point of Presence linked to National Pension System (NPS) Incorporated. The nominee(s), family member(s) as specified by the service rules, or legal heir(s) of the deceased subscriber shall submit the claim settlement application along with the required documents to the associated point of presence through corporate, in the event of death or subscriber being declared missing.

Q3.What will my exit compensation be?

A minimum of 40% of the total pension value will be converted into a monthly annuity or pension through annuitization. However, the subscriber has the choice to use more than 40% of their total retirement assets to buy an annuity. Lump amount – The subscriber will receive the remaining 60% of the accrued pension wealth.

Q4. Is it possible for me to fully cash out my accrued pension assets without annuitization?

If your total pension worth is equal to or less than Rs. 5 lahks, then yes.

Q5. Will I receive an annuity if I entirely withdraw my pension wealth?

No, the subscriber will no longer be eligible to receive any pension benefits or other payments under the NPS.

Q6. If all of my collected pension wealth has been removed, will I still receive an annuity?

No, the subscriber’s right to receive any pension or other sum under the NPS will expire.

Q7. What will happen if I don’t retire by the time I’m 60 years old or superannuated?

Up until the age of 75 (seventy-five), you will continue to be a member of the NPS, and PRA will switch from an employer-to-all-citizens paradigm.

Q8. Is it possible for me to leave during the automatic continuation period that has been prolonged past the age of 60 or during my superannuation?

Yes, the subscriber may leave NPS at any time by making a request to the relevant point of presence or NPS Trust.

Q9. What will happen if a subscriber passes away while the automatic continuation is in effect?

The nominee(s) or legal heir(s) of the subscriber shall receive the whole amount of the subscriber’s accumulated pension fortune.

Q10. Is it possible for a nominee or the subscriber’s legitimate successor to purchase an annuity?

Yes, any of the annuities given upon exit may be purchased by the nominee(s) or legal heir(s) of the Subscriber.

Q11. Can I postpone my withdrawal of a lump sum?

Yes, you may postpone taking the lump sum payment. A delay of this kind is possible until the age of 75.

Q12. What would happen if a subscriber passes away while the lump sum withdrawal is being postponed?

If the subscriber passes away while the deferment period is in effect, the deferred lump sum amount will be paid to the nominee(s) or legal heir(s) of the subscriber (s).

Q13. Can I postpone buying an annuity?

You can postpone buying an annuity, yes. Such a deferral may be granted for a maximum of 75 years.

Q14. Is it possible to purchase an annuity during the deferment period?

Yes, by making a request to NPS Trust or any other intermediary or company designated by the Authority for this purpose, the subscriber has the opportunity to acquire an annuity at any moment throughout the deferment period.

Q15. Can I use the delay of lump sum and/or annuity over the prolonged term if I continue my Tier I of PRA even after reaching the age of 60 or superannuation?

No, after exercising the option to continue after turning 60 years old, Benefits deferment options (lump sum and/or annuity) are not permitted during superannuation.

Q16. Is it possible to postpone the lump sum withdrawal and/or annuity purchase during the automatic continuation period?

The option to delay a lump sum withdrawal and/or the purchase of an annuity is not accessible, nor are alternatives to delay benefits (lump sum and/or annuity).