Credit Score

A few years before, when the three major credit reporting agencies first adopted the FICO Score, A new and mysterious concept that come out to consumers is the credit score. Many people didn’t understand how credit scores work, and also, they have no idea related to their own credit scores stood.

As time passed, more people began to pay attention to these important 3-digit numbers and how they’re calculated. Consumers learn about their credit scores could have a significant impact on their ability to qualify for financing, and how much they would pay to borrow money. But still, not everyone fully understands the credit score.

What is the Credit score?

A credit score is a 3-digit number that defines your credit history. A credit bureau takes your credit history into consideration and uses its own technique to calculate a 3-digit score, in the range of 300 to 900. The higher the credit score, the more easily you will get credit. Most banks prefer to give loans to borrowers with a credit score of 700 or above. Borrowers who have poor credit scores must pay a higher interest rate.

What is the Cibil score?

CIBIL stands for Credit Information Bureau (India) Limited. Although the term CIBIL score is considered synonymous with credit score, CIBIL is one of the four credit bureau companies in India that provide credit information. The four companies are TransUnion CIBIL, Equifax, Experian, and CRIF Highmark.

Each of the four companies can provide you with a credit history. Although, a credit score generated by TransUnion CIBIL is known as a CIBIL score.

What is the Difference Between a Cibil Score and a Credit Score?

CIBIL score is a credit score generated by the credit rating agency called TransUnion. TransUnion CIBIL is the gold standard of credit score and the only one that matters while seeking finance. While there are several credit bureaus that issue credit scores, CIBIL is the one that holds the most weight with banks. At a time, a credit score is like your financial report card with a numerical evaluation of your credit health. CIBIL score in India can be anywhere between 300 to 900 and CIBIL score above 750 is considered good for loan or credit card approval. While evaluating any type of credit application, the lender checks your credit score and your credit history before proceeding with the application.

So, you cannot point to a better score as every agency has its own parameters to calculate credit scores and CIBIL TransUnion is one of them. Usually, a CIBIL score of 750 and above is enough to get quick approval for a loan.

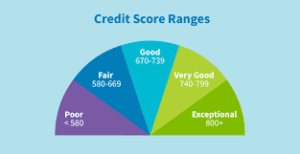

Credit Score Range and What It Means

A credit score in India ranges between 300-900. You should always take measures to bring your credit score closer to 900. A higher credit score increases your chances of getting a good deal on loans as well as credit cards.

- Credit scores range is between 350 to 549

This means that you are late in paying the credit card bill or EMI for the loan. With a credit score in this range, it will be difficult for you to get a loan or credit card as there is a substantial risk of you turning into a defaulter.

- Credit scores range is between 550 – 649

This means that you have an appropriate credit score. It says that you are struggling to pay the dues on time. Interest rates on loans can also be high.

- Credit score range is between 650 – 749

It means you are on the right path. You have good credit behavior, and it will increase your score further. Creditors will consider your credit application and may offer you a loan. Although, you may still not have the negotiation power to get the best deal on the rate of interest for the loan.

- Credit score range is between 750 – 900

It means you have an excellent Credit score. This shows that you have been making regular credit payments and have an impressive payment history. Banks will easily give you loans and credit cards, considering that you have the lowest risk of becoming a defaulter.

How is Credit Important?

Maintaining a good credit score helps you obtain money easily. A bank issues its trustworthiness in the place of the credit score that a client maintains for himself. Higher the credit score, easier to get loans, and vice versa. It helps the banks to determine to whom they could lend, how much they could lend, and at what interest rate. If your credit score is bad, it makes the bank skeptical about giving you any amount.

Some of the Factors Affecting Credit Score

Some of the crucial factors that have a negative effect on the credit score are:

- Missing repayments: Payment history affects the credit score. This means even a single 30-day overdue payment or missed payment can have a negative impact on your credit score.

- Using all available credit: High credit usage can indicate trouble to borrowers, and it means that the borrower is too dependent on credit. Credit usage is calculated by dividing the total amount of revolving credit that a borrower is currently using by the total of all the available credit limits. Lenders like to see credit usage under 30% and if it’s under 10% that is considered even better.

- Too high credit in too little time: Every time a lender requests a borrower’s credit reports for making a lending decision, a hard inquiry is recorded in the credit file These inquiries hold on the file for two years, and if the result of credit scores go down slightly for a period. Lenders look at the number at the time of hard inquiries to measure how much new credit the borrower is requesting. Too many inquiries in a brief period can signal that the borrower is in a bad financial situation, so the bank refuses to provide new credit.

Default Account: Types of negative account information that may appear on a borrower’s credit report include foreclosure, bankruptcy, arrears, debits, settled accounts. Any of them can seriously damage your credit for many years.

Some Ways to Improve Credit Score

While trying to assess ways of improving credit scores, it is important to focus on the reasons why the credit score could be struggling. So, they permit the borrower to develop better credit habits and have a positive influence on the credit score eventually.

Here are some of the ways in which a borrower can improve their credit score:

- Regular Bill Payments: Payment history is the most crucial factor in making up a borrower’s credit score and hence making all the due bill payments on time every month is helping to improve the credit score.

- Debt Repayment: Reducing credit card balances is a wonderful way to lower the credit utilization ratio and can be one of the easiest ways to see a credit score boost.

- Completing Outstanding or Past-due Payments: If a borrower has any Outstanding payments, bringing them up to date may save his or her credit score from taking an even bigger hit. Late payment information in credit files includes how late the payment is outstanding for 30,60, or 90 days and the more time that has taken to proceed, the larger will be the impact on credit scores.

- Disputing Inaccurate Reports: There is a possibility that a credit score report could contain inaccurate information about the borrower and this can be disputed by doing proper research and submitting good evidence. There is a requirement for regular monitoring of credit scores and related information. The faster a dispute is raised, the more chances of it getting corrected.

- Make sure you have a credit score: For borrowers who want to get a genuine credit score, the best alternative is to seek a credit score from an established and reliable source online. Credit Mantri is a helpful source that can provide accurate and detailed credit score reports that can be used to establish a good credit history.

How is the Credit or CIBIL score calculated?

Credit bureaus approach at credit score ratings, based on four prime factors. These include:

- Repayment history

- Existing loan and credit utilisation

- Type of loan and tenure

- Number of credit inquiries

Benefits Of A Good Credit Score

A good CIBIL score improves loan eligibility, loan approval chances and increases your likelihood of landing competitive loan terms.

Let’s look at some benefits of a CIBIL score above 750.

- Increase the chances of approval

A high CIBIL score reflects your creditworthiness and clean credit history to potential lenders. This credit score means lenders trust your ability to repay the loan amount. High online credit score results in easy to get approval, quick loan processing, and a speedy fund disbursal.

- Better Interest Rates

A high credit score also includes the ability to negotiate better terms. A high online CIBIL score can help you qualify for attractive loan interest rates by reducing your overall repayment amount.

- Higher loan amount

Since a good credit score indicates reliable credit behavior, it is possible to obtain a higher loan amount at competitive interest rates.

- Pre-approved loan offer

If you have a strong financial background, a high credit score, and a disciplined credit report free of loan defaults, lenders can also pitch your pre-approved loan offers. Besides, since the lending institution performs an online CIBIL score verification and pre-approves the loan amount, your online credit score will translate into attractive interest rates and flexible loan tenures.

Effects of Bad Credit Score

- High-interest rates on credit cards and loans

- Credit and loan applications may not be approved

- Getting denied for employment

- Higher insurance premiums

What are Credit Bureaus?

A credit bureau is an agency creating credit scores by collecting and analyzing credit data, including credit cards used, loans taken, overdraft facilities, etc., associated with people or business entities. There are four credit bureau companies in India that provide credit information. The four companies are:

- TransUnion CIBIL

- Equifax

- Experian

- CRIF Highmark