Know Your Customer (KYC)- A Quick and Easy Way to Identify Your Customers

Is Know Your Customer (KYC): A Simple Definition

- KYC was introduced in 2002 by the Reserve Bank of India

- The procedure is known as anti-money laundering

- KYC assists in getting to know the customers

- Its goal is to reduce money laundering in the finance market

- All financial institutions must follow KYC procedures, according to the RBI

- Both new and existing customers need to provide KYC

- Financial institutions must keep KYC records up to date on a regular basis

- KYC helps to detect fraud in customer accounts

There are multiple online services available today, the KYC (Know Your Customer) process has become one of the most important steps in establishing business-user relationships. It is the fundamental process of authorizing an individual to become a registered user or customer of a given organization in a secure and compliant manner.

KYC facilitates customer onboarding for businesses, as well as plays an important role in identity fraud prevention and Anti-Money Laundering (AML) controls. It is an approach whose integration and development by organizations and companies have an impact on their operations and the expansion of their activities.

What is the meaning of “Know Your Customer”?

Know Your Customer (KYC) standards are intended to protect financial institutions from fraud, corruption, money laundering, and terrorist financing.it is a mandatory procedure for verifying the identity of the online platform or product users, but it is also required during customer onboarding to collect the necessary information.

The digital transformation of businesses and the widespread use of the Internet necessitate the development of new exchange regulations to prevent identity theft and secure transactions. The KYC procedure was thus initiated to validate customers’ identities, whereas the KYB (Know Your Business) procedure identifies a company’s legal representative and the KYS (Know Your Supplier) procedure validates its suppliers.

KYC procedure digitization is defined by the 5th anti-money laundering directive (5AMLD or AML5) as well as the eIDAS regulation (Electronic Identification And Trust Services). This regulation provides the legal guarantees and protection required to implement user digital onboarding procedures in a secure manner.

While KYC is beneficial in all industries, it is especially important in combating online fraud in financial and banking institutions, as well as related industries such as insurance, investment firms, trade, real estate, and so on.

What is KYB?

Know Your Business, or KYB, is a method for confirming the authenticity of corporate organizations or firms with which you are doing business. This is just as important as following KYC guidelines. The business verification procedure includes checking Ultimate Beneficial Owners (UBOs), third-party corporations, and other corporate entities. KYB shields you from the risks of dealing with shady businesses. Not only that but there are also regulatory requirements to consider.

Know Your Business, or KYB, is a method for confirming the authenticity of corporate organizations or firms with which you are doing business. This is just as important as following KYC guidelines. The business verification procedure includes checking Ultimate Beneficial Owners (UBOs), third-party corporations, and other corporate entities. KYB shields you from the risks of dealing with shady businesses. Not only that but there are also regulatory requirements to consider.

Type of KYC

There are two types of KYC

-

CKYC

A Central KYC Registry is a repository of KYC records. When an individual submits KYC documents, they are registered in the repository and assigned a unique CYKC number. For any financial transaction, the CYKC number can be used instead of submitting physical KYC documents. All financial institutions can access the CYKC repository to verify their customers’ KYC information.

-

eKYC

An e-KYC is a paperless and imitated online verification strategy based on an Aadhaar card. To be more specific, it is the point at which you approve and authorize the electronic KYC procedure. It has significantly reduced the amount of time needed to check documents. The procedure, which took weeks before, can now be completed in a matter of days.

By using eKYC, you authorize the Unique Identification Authority of India (UIDAI) by providing your Aadhaar card number. You are providing personal information such as your name, gender, age, address, and even your thumb and eye retina impression by doing so. So, in essence, KYC is digitalized by electronically linking your Aadhar card to banks and other required places.

KYC Form:

Proof of identity and proof of address are included in two types of KYC documents available. KYC registration agencies (KRA) such as CAMSKRA and CVLKRA centrally maintain the records filled out in the KYC form by the investor. If you are KYC compliant, you do not need to fill out KYC forms for each intermediary separately. All of your information will be stored and accessed centrally by KRA, and the intermediary with whom you are interacting will have electronic access to it. The KRA websites can also be used to check your KYC status.

Agencies of KYC Form

To assist investors in becoming KYC compliant, five different KYC Registration Agencies (KRAs) are in place. Each KRA provides you with a KYC form, which you can download, fill out, and submit along with the necessary documents.

-

CAMS KRA Form

CAMS, which stands for Computer Age Management Services Pvt Ltd, was founded in 1988 with the goal of focusing on software development. CAMS has established a subsidiary, CAMS Investor Services Pvt. Ltd. (CISPL), to handle KYC processing. In June 2012, CISPL was granted the authority to act as a KRA. CAMS KRA was launched by CISPL in July 2012 to standardise the KYC verification process for all SEBI-regulated financial intermediaries. CAMS KRA also offers a paperless Aadhaar-based verification process to complete the KYC requirements before beginning to invest in Mutual Funds. Along with that, it performs the traditional PAN-based KYC process.

-

CVLKRA Form

CDSL Ventures Limited – CVL – is a completely owned subsidiary of the central depository Services of India (CDSL). CDSL is the second securities Depository in India (the first being NSDL). CVL relies on its expertise in the securities Market domain and maintaining data confidentiality. CVLKRA was the first central-KYC (cKYC) Registration Agency for the securities market. CVL KRA keeps the records of the investor in a centralized manner on behalf of the securities market intermediaries that are compliant with SEBI.

-

NSE KRA Form

According to WFE, the National Stock Exchange (NSE) is the country’s leading stock exchange and the fourth-largest in the world in terms of equity trending volumes in 2015. (World Federation of Exchanges). The NSE offers real-time and high-speed streaming of trade quotations and other market-related data. NSE has a fully functional business structure. With the assistance of its subsidiary DotEx International, the NSE launched its KYC registration agency (KRA). Following the implementation of the KRA regulation by SEBI in 2011, NSE decided to offer the KRA Facility. The National Stock Exchange provides listing services, clearing and settlement services, trading services, indices, and so on. It intends to continue delivering innovatively in both non-trading and trading business environments, while also providing clients with high-quality data and services. It aims to continue delivering innovatively in both non-trading and trading business environments, providing quality data and services to clients and other Market Participants.

-

Karvy KRA Form

Karvy Data Management Services (KDMS) is an emerging leader in the provision of business and knowledge process services in India. It is primarily concerned with the delivery of business-related services using an innovative strategy. KDMS introduced KRISP KRA, also known as Karvy KRA, to investors. KDMS intends to broaden its reach by capitalizing on the growing penetration of financial products in the Indian market. Karvy operates as an independent institution, supported by a strong team of seasoned professionals and cutting-edge data management technology. Karvy KRA maintains client records in a centralized manner on behalf of SEBI-registered market intermediaries.

-

NSDL KRA Form

National Securities Depository Ltd. wholly owns NSDL Database Management Limited (NSDL). NSDL Data Management Ltd (NDML) is a national leader in the provision of business and knowledge process services. It is primarily concerned with providing the best possible services through the use of an innovative framework. NDML intends to keep its top position by capitalizing on the current retail sector boom in the Indian market. NDML KRA operates as an independent entity, supported by a strong team of professionals with extensive experience. NDML KRA employs cutting-edge data management technology to centralize its clients’ information records. It performs this function on behalf of SEBI-compliant securities market entities.

What is the procedure for completing your KYC verification?

-

Offline KYC

For the offline process, here are steps to follow.

- Download the KYC form

- Fill it in with your details, specifically Aadhaar or PAN

- Visit the nearest KYC registration agency office (KRA)

- Submit the form with the attached ID and address proof

- Furnish biometrics if required

- Collect the application number and track your application status online

While this process is quite simple, it does require legwork and can take longer too.

Here, KYC verification can take up to 7 days. Alternatively, the Aadhaar-based biometric authentication KYC process can be quicker as it has a few in-person interactions combined with online provisions.

-

Online KYC

For KYC online verification, there are two options: Aadhaar-based biometric KYC or Aadhaar OTP. The latter is the quickest and you can get your KYC process completed in minutes. Here’s how you can go about it.

- Visit the official website of any KRA

- Create your account with personal details

- Provide your Aadhaar number and registered mobile number

- Enter the secure OTP to verify

- Make a self-attested copy of your e-Aadhaar and upload it

- Accept the declaration terms

On the other hand, with Aadhaar-based biometric KYC, there are a few different steps. It is important to note that it starts online.

- Visit the official KRA website

- Follow the same KYC online steps as mentioned earlier

- Choose the biometric authentication online option

- Wait for an authorized representative to visit the address mentioned in the form

- Provide biometric verification

- Show original documentation as requested

- Await approval of your KYC

KYC verification online can be done in less than 24 hours, whereas if done offline, the verification takes about a week. Since KYC is required when you want to open a bank account, start off with investments, and so on, it is preferable to verify your KYC online.

Note: KYC Registration Agency (KRA) is an agency registered with SEBI under the Securities and Exchange Board of India [KYC (Know Your Client) Registration Agency] Regulations, 2011. The KRA will maintain KYC records of the investors centrally, on behalf of capital market intermediaries registered with SEBI.

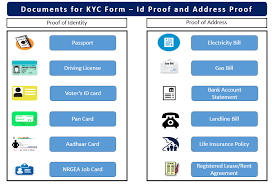

Documents are Required for KYC Verification

The Indian government has listed six documents as officially valid documents (OVDs) for identity proof. You can submit any of the following documents for identity verification: a voter ID card, an Aadhaar card, a Pan card, a passport, a driving license, and NERGA job cards. If they contain an address, any of these documents can be used for address proof; otherwise, you will need to submit additional documents for address proof.

If you don’t have any of these documents, the following will be accepted for KYC -utility bills (electricity bills, water bills, phone bills, etc.), bank statements, and municipal tax bills.

-

Verification of information

Once the user uploads a document as proof, the document template is identified and examined against several checks. It is to ensure the uploaded document is not tampered with or photoshopped. Once it’s validated, the data is extracted. There can be two ways to fetch the data from documents:

Data extraction through OCR in which the system automatically extracts the data from the identity document and checks the authenticity of the information.

Data extraction without OCR in which the user manually enters the information and the IDV solution checks the user-entered information against the one present on the identity document.

-

Customer Identification Program

In the KYC procedure, the Customer Identification Program (CIP) is the initial step. The identification of high-risk customers should be done beforehand to mitigate the risks. The mandate of CIP is to ensure that the entity performing a financial transaction is verified. This is necessary to curb money laundering, terrorist financing, and other illegal criminal activities that disrupt the overall financial system.

In CIP, financial institutions are supposed to collect user information to open a bank account. This information includes

- Name

- Address

- DoB

- Identification number

After collecting this information, it is verified against supporting shreds of evidence that could be in the form of biometric verification or document verification. In addition to this, CIP includes a risk assessment of customers and business accounts. This helps financial institutions build parameters against which each customer will be given a risk rating. KYC procedures, therefore, are predefined that contribute to the prevention of fraud. At this point, businesses decide on CDD and EDD procedures.

-

Customer Due Diligence

This is a process in which a customer’s information is screened against KYC protocols. In KYC compliance, this is the second step in which basic customer information is collected online in real-time. In CDD, the information collected includes;

- Name

- Address

- Age

- Date of birth

All this information is used to verify the onboarding of customers. After this, the customer is assigned a rating as per credentials after the AML screening procedures and financial credibility. In case, if the customer ID is found in watchlists or PEP records, the risk is considered high and further Enhanced Due Diligence process is performed.

CDD concludes that how much a customer profile is a risk for an institution. In private and offshore banking, CDD is supposed to be done more deeply to inspect any suspicious identities in the system. CDD should be a scalable method that could ultimately reveal the involvement of money laundering and terrorist funding in the financial system by identifying the identities.

-

AML Screening

KYC compliance does not end here. One-time customer verification does not conclude the inevitable credibility of that identity. Instead, a continuous identity screening should be performed in an institution to deter the risks of fraud from even the authorized entities. The ongoing financial transaction monitoring is important to identify suspicious transactions and unusual money flow in the financial system.

For this, a risk mitigation strategy is defined that includes parameters against which monitoring needs to be performed. These indications include;

- Transaction above the specified threshold

- A large number of frequent transactions

- Unusual/suspicious activities

What is the purpose of the Know Your Customer (KYC) process?

The Know-Your-Customer (KYC) procedure is important for preventing fraud and other illegal financial activities. KYC protects financial institutions from being used for money laundering without their consent.

Companies that provide services such as stock brokerage, mutual fund investments, and other financial services benefit from the KYC process. Banks and financial institutions use KYC to verify a company’s legal status, as well as the legal status of its owners and authorized signatories. It also helps in the verification of the authenticity of individuals and financial institutions.

Banks and other financial institutions in India can use Know Your Customer (KYC) to:

- Accurately identify customers.

- Examine the activities of the customers and ascertain their source of income.

- Determine whether or not the customer poses a risk of money laundering.

When is it necessary to complete know your customers?

As a customer, you need to fill up the Know Your Customer (KYC) Form when you want to:

- Invest in mutual funds

- Open a bank account

- Request for financial planning services through a registered board

- Apply for a credit card, personal loan, home loan, or any kind of a loan

- Change the signatories, beneficial owners, etc. on your accounts

- For any kind of insurance whether it is life insurance or car insurance.

- To have a locker in the Bank.

Advantages

- Establishing customer identity Helps to understand the nature of the customers’ activities

- Assessing money laundering risks associated with customers for the purpose of monitoring customers’ activities

- Providing protection from losses and fraud due to inappropriate and illegal fund transactions

Disadvantage

- Know your customer imposes a significant financial burden on businesses, particularly smaller financial firms, where compliance costs are disproportionately high.

- Customers may find the requested information intrusive and burdensome and may opt out of the business relationship as a result.

- Even though living a nomadic life makes it increasingly difficult or impossible to hold any formal banking relationship anywhere in the world due to a lack of proof of address, bills, and/or debt documentation required by KYC, innocent, law-abiding individuals such as digital nomads are very likely disproportionately disadvantaged.

- Retirees who travel within their own country without having a permanent or fixed address may be disproportionately disadvantaged.

Conclusion

Knowing the customer consists of identifying and then verifying all authentic credentials. It can be done before or during the start-up of a business, the opening of a bank account, or the formation of any type of partnership. KYC contains financial information as well as any other information necessary to get to know your customer. KYC services are critical for any business and must be implemented to secure and transparent cash flow. Finally, KYC verifications benefit not only one party, but getting accurate information to protect all parties involved in the business. KYC has a wide range of goals, but it also has some drawbacks. To avoid the exploitation of customers and their identities through system loopholes, proper KYC systems must be installed.